Association of Chartered Certified Accountants (ACCA)

About ACCA Course

ACCA Course stands for Association of Chartered Certified Accountants. ACCA is a globally recognised professional body based in the UK and is the largest confederation of account professionals with over 228000 qualified members and counting, alongside half a million students enrolled across 180+ countries.

The ACCA certification is accepted globally for the high standards and quality of the course, which includes a myriad of professionally orientated developmental activities. It prepares the students for a global career in finance and accounting through a complete curriculum and continuous professional growth.

Why ACCA Course?

Globally recognised in 180+ countries

Globally recognised in 180+ countries

The initial 4 exams are available on demand

The initial 4 exams are available on demand

Computer-Based Exams

Computer-Based Exams

Pass rate over 50% – higher than many other finance exams

Pass rate over 50% – higher than many other finance exams

Over 2.4 lakh members & 5.4 lakh students worldwide

Over 2.4 lakh members & 5.4 lakh students worldwide

ACCA salary packages in India start from ₹12 LPA

ACCA salary packages in India start from ₹12 LPA

Strong placements after ACCA in top MNCs

Strong placements after ACCA in top MNCs

The ACCA course certification helps you build a global accounting career. With flexible exam schedules and a strong industry reputation, it’s the smart choice for finance professionals.

100% Placement Assistance & Pass Guarantee after completing ACCA Course

ACCA Course Subjects

The ACCA course subjects are divided across 3 levels—Applied Knowledge, Applied Skills, and Professional, which includes a total of 13 exams. If you have a credential such as a B.Com or a C.A., you can get exemptions from 1 to 9 subjects.

Applied Knowledge

3 Papers

Business & Technology (BT)

Business & Technology (BT)

Management

Accounting (MA)

Management

Accounting (MA)

Financial

Accounting (FA)

Financial

Accounting (FA)

Applied Skills

6 Papers

Corporate and

Business Law

(LW)

Corporate and

Business Law

(LW)

Performance

Management (PM)

Performance

Management (PM)

Taxation (TX)

Taxation (TX)

Financial Reporting

(FR)

Financial Reporting

(FR)

Audit & Assurance

(AA)

Audit & Assurance

(AA)

Financial

Management (FM)

Financial

Management (FM)

Professional

4 Papers

Strategic Business Leader (SBL)

Strategic Business Leader (SBL)

Strategic Business Reporting (SBR)

Strategic Business Reporting (SBR)

Advanced Financial Management (AFM)

Advanced Financial Management (AFM)

Advanced Performance Management (APM)

Advanced Performance Management (APM)

Advanced Taxation (ATX)

Advanced Taxation (ATX)

Advanced Audit & Assurance (AAA)

Advanced Audit & Assurance (AAA)

ACCA Course Eligibility

The ACCA Course is open to everyone, no matter if you are a student or a professional. Whether you’re planning to elevate your career after Class 10, 12 or graduation, there’s a defined entry path for everyone. Go through the section below to check out the ACCA course eligibility criteria based on your level.

| Degree | Exemptions | Subjects Exempted |

|---|---|---|

| 10th Grade | Foundation in Accountancy (FIA) Route | - |

| 12th Grade | No Exemptions | - |

| BBA | Upto 3 Exemptions | BT, FA, MA |

| MBA | Upto 3 Exemptions | BT, FA, MA |

| B.Com | Upto 5 Exemptions | BT, FA, MA, LAW, TX |

| IPCC Cleared | Upto 5 Exemptions | BT, FA, MA, TX, AA |

| CA Intermediate + Graduation | Upto 6 Exemptions | BT, MA, FA, LAW, TX, AA |

| Qualified CA | Upto 9 Exemptions | BT, MA, FA, LW, PM, TX, FR, AA, FM |

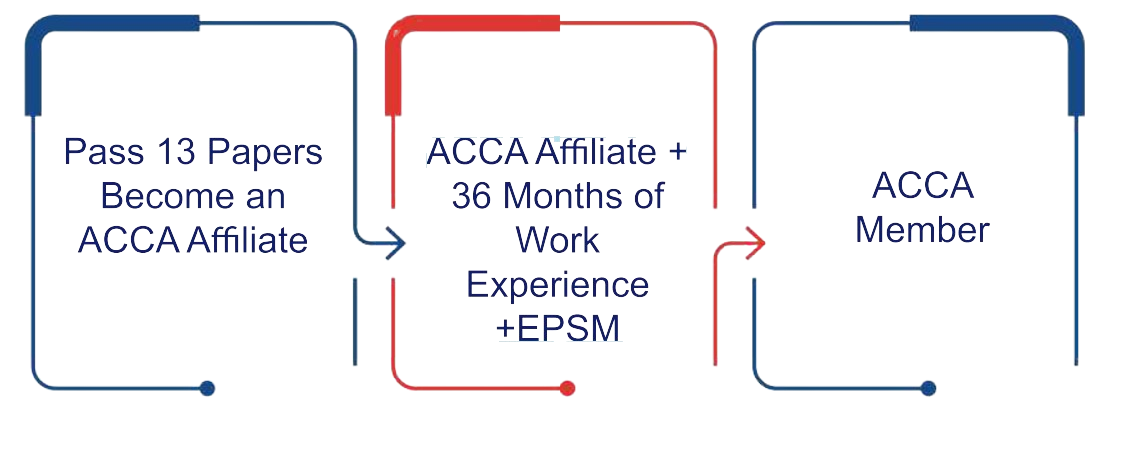

ACCA Course Certification Process

To get the official ACCA Course Certification, here’s what you would need to fulfil:

- Pass all levels: Pass 4–13 exams (depending on qualification exemptions) across the 3 levels.

-

Complete Practical Experience Requirement (PER):

- 36 months of relevant work experience are mandatory.

- Experience can be gained before, during, or after exams.

- Must be signed off by a qualified supervisor.

- Complete the Ethics and Professional Skills Module: Required before taking the final level exams.

Once all of the above requirements are met, you’re awarded the ACCA membership certificate, which is recognised globally in 180+ countries.

Why VGLD

Scholarship For VGLD Students after ACCA Course

No Exemption

INR 9,800/-

Avail ACCA Registration + Classes for BT,MA,FA & LW

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Exemptions

INR 43,100/-

NOTE: (Paper F1-F4) GBP 15 per exemption needs to be paid to ACCA to claim these exemptions. Also, 50% of Annual subscription for calendar year 2024 to be paid by student.

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 134 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

5 Exemptions

Avail up to 9 Exemptions

NOTE : (Paper BT, MA, FA, TX &

AA)

GBP 15

per exemption needs to be paid to ACCA to claim these exemptions and Additional

exemptions claimed on the basis of B.com (H) and 40+ marks in CA Final level

exam of

Costing, SFM, FR shall be 100% PAID exemptions by the student.

Exemption Fee = Exam Fee. Also, 50% of Annual subscription for calendar year

2024 to

be

paid by the student

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 116 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

9 Exemptions

INR 87,600/-

INR 56,200/-

NOTE: (BT, MA, FA, LW, PM, TX, FR, AA & FM) GBP 15 per exemption needs to be paid to ACCA to claim these exemptions. Also, 50% of Annual subscription for calendar year 2024 be paid by the student.

SCHOLARSHIP INCLUDES (As applicable)

Initial Registration: Discounted Initial Registration.

Annual Subscription Fees: GBP 134 for 2023 and 50% waiver off Annual Subscription for calendar year 2024 for B.Com (H), IPCC & ICAI members only

Exemption Fees: Knowledge Level Papers – GBP 84 each Skills Level Papers – GBP 123 each

Meet Our Expert Faculty

Learn From Industry Experts

Placements after ACCA course with VGLD

After completing the ACCA Course, you will have several opportunities and job roles in various sectors:

- Financial Analyst

- Internal Auditor

- Tax Consultant

- CFO (Chief Financial Officer)

- Management Accountant

- Risk and Compliance Manager

Top Companies Hiring ACCA Professionals:

- Deloitte

- KPMG

- PwC

- EY (Ernst & Young)

- Grant Thornton

- BDO

- HSBC

- Barclays

After completing the ACCA course, you can grab the opportunity to work in international markets such as the UK, Singapore, UAE, Canada, or Australia and in sectors like banking, consulting, fintech, government, healthcare, as well as manufacturing.

Blogs

Frequently Asked Questions (FAQs)

1. What is ACCA?

ACCA stands for Association of Chartered Accountants. It is a UK-based syndicate/group of qualified professional accountants which is over 100 years old. It is a globally recognised accounting qualification.2. Where is ACCA recognised?

ACCA is recognised in 180+ countries, including the UK, UAE, Singapore and many more.3. Where are ACCA jobs available?

ACCA jobs are available across the globe! To check, choose your desired country from the link below:ACCA Global Jobs Portal

4. How many exemptions does a qualified CA get in ACCA?

A Qualified CA gets exemptions of up to 9 papers, just leaving 4 papers to appear for.5. How many exemptions does a CA IPCC student get?

CA IPCC (now ICAI Intermediate) students typically receive exemptions for 5 ACCA papers, and may get an additional exemption (in Corporate & Business Law) if they hold a B.Com degree.6. How many exemptions are there for a B.Com graduate?

A B.Com graduate from a recognised university may get up to 5 exemptions.7. How many total papers are there in ACCA?

There are a total of 13 papers in ACCA, with 2 optionals, grouped across three levels:Applied Knowledge (3 papers)

Applied Skills (6 papers)

Strategic Professional (4 papers)

8. Is there any aggregation/grouping in ACCA?

No, there is no aggregation or grouping in ACCA. Students just need to score at least 50% in each paper to pass.9. Is there a fixed sequence for appearing for ACCA exams?

No, ACCA is completely flexible. You can appear for any paper within the level in any sequence.10. How many times are the ACCA exams held in a year?

ACCA exams are held 4 times in a year: March, June, September and December. The first four exams are On-Demand and can be given at any time.11. What makes you an ACCA member?

Completing the 3 E’s of ACCA, namely Exams, EPSM and Experience makes you an ACCA member.12. How many years of experience (PER) is required?

A candidate must have 36 months of practical training in ACCA that can be completed at any time before, after or during the exam.13. Is CA Articleship recognised in ACCA PER?

Yes, CA Articleship is recognised as ACCA PER.14. What is VGLD accreditation in ACCA?

VG Learning Destination (VGLD) is a Gold Approved ACCA Learning Partner. It is a prestigious accreditation awarded to top-tier global training providers that meet the rigorous quality standards set by ACCA.This means that they:

- Deliver coaching using trusted quality materials.

- Have qualified ACCA professionals as faculty.

- Provide robust exam preparation support, including mock tests and practice platforms.

15. Does VGLD provide any Scholarships for ACCA?

Absolutely! There is a scholarship opportunity available from VGLD for up to Rs 88,000/-! Exemptions and scholarships depend on your entry-level qualification in the ACCA.16. Can we start ACCA right after 12th?

Yes, a candidate can start their ACCA preparation right after their 10+2 examination.17. Can I start ACCA while in school?

Yes, you can start your ACCA course preparation while you are still in school. If you have completed your 10th grade, you can begin with the Foundations in Accountancy (FIA) route which is a specially designed entry point for younger students.18. Are ACCA classes online or offline?

ACCA classes from VGLD are LIVE online classes over the weekends with 100% backup through recorded sessions and study materials for anytime access and revision.19. Top 10 Companies in India that hire ACCAs?

Some leading employers that frequently hire ACCA members are:Ernst & Young (EY), PricewaterhouseCoopers (PwC), Deloitte, Grant Thornton, BDO, Citibank, Protivity, Accenture, St. Martin’s, Amazon

20. Careers After ACCA?

ACCA can give you many opportunities in fields like Accounting, Finance, Audit & Assurance, Taxation, Insolvency, Forensic Accounting and many more.21. CA vs ACCA

| Parameters | CA | ACCA |

|---|---|---|

| Recognised | Only in India | Recognised in 180+ countries |

| Flexibility | Low- exams are done in set groups | Complete Flexibility, can choose any paper within the level in any order |

| No. of papers | Need to attempt all papers in the group | Complete Flexibility- can choose a minimum of 1 paper in the level |

| Exam | Set sessions (CPT, IPCC, Finals) | Complete flexibility to choose first 4 exams as per own convenience |

| Frequency of Exams | Twice a year | Four times a year |

| Training | 2½ years of articleship before finals | No such requirement. 36 months PER (work experience) can be completed before, during, or after exams |

| Duration | 6-8 years | 3 years |

22. MBA vs ACCA

| MBA | ACCA |

|---|---|

| Often includes general subjects like Marketing, HR, and IT and many of these subjects are irrelevant to core finance careers. | ACCA, on the other hand, has a hands-on approach where the students can deal with high level of practical content rather than just theoretical concepts. |

| College-dependent and are often limited to domestic opportunities. | ACCA students can get access to global job portals and they are frequently placed with the Big 4 firms and MNCs. |

| Many MBAs begin in entry-level positions and work their way up. | ACCA's can attract more senior roles at managerial or director level which will contribute to accelerating their careers. |

23. ACCA Exam time-table

The ACCA Exams are held 4 times in a year, generally in the first week of March, June, September and December.Exact date sheet is available at:

ACCA Exam Dates

24. What is PER?

It’s one of the 3 essential components to become a fully qualified ACCA member (alongside passing exams and completing the Ethics and Professional Skills Module).- 36 months of relevant supervised work experience

- Completion of 9 performance objectives (5 Essential + 4 Technical)

- Maintain progress on ACCA's MyExperience portal

- Get sign-off from an approved supervisor

+91-9700000038

+91-9700000038 Direction

Direction